January 2019 Hotel Performance

Feb 21, 2019

January 2019 Hotel Performance

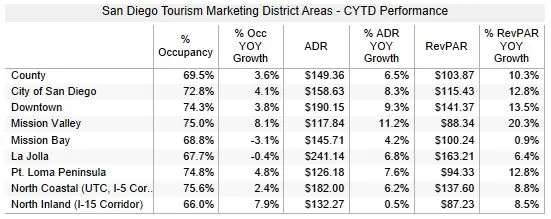

San Diego properties saw strong growth compared to 2018, but actuals fell below most of the western region comp set cities.

Occupancy

- SD County occupancy was 69.5%, up 3.6% from 2018

- City of San Diego was 72.8%, a 4.1% improvement from 2018

- The best performing regions for the month were North Coastal (UTC, I-5 corridor) with occupancy at 75.6%, followed by Mission Valley at 75%

- The regions with the most growth in January were Mission Valley with an 8.1% increase over last year, followed by North Inland (I-15 corridor) at 7.9% growth

- San Diego County’s occupancy for January ranked 9th among top 25 markets, behind Oahu (82.6%), Miami (78.6%), Orlando (74.9%), Phoenix (73.6%), San Francisco (73%), Los Angeles (71.6%), New York (71.4%), and Tampa (70.8%)

- Occupancies Sundays through Wednesdays were up (Mondays were up 13%!), while Thursdays were flat, and Fridays & Saturdays declined slightly

- SD County occupancy was 69.5%, up 3.6% from 2018

ADR

- SD County ADR was $149.36, a 6.5% increase from 2018

- City of San Diego was $158.63, up 8.3% from 2018

- The best performing regions for ADR were La Jolla at $241.14, followed by Downtown at $190.15

- The regions with the most ADR growth in January were Mission Valley with a 11.2% increase over 2018, followed by Downtown with a 9.3% increase

- San Diego County’s ADR ranked 8th among top 25 markets, behind San Francisco ($302.68), Oahu ($242.70), Miami ($234.16), New York ($181.92), Los Angeles ($172.45), Anaheim ($154.02), and Phoenix ($150.93)

- All days of the week saw substantial increases in ADR, again with Monday leading with 11% improvement

- SD County ADR was $149.36, a 6.5% increase from 2018

RevPAR

- SD County RevPAR was $103.87 for the month of January, a 10.3% increase from 2018, and ranked 8th among top 25 markets

Members can view the report in full on membernet.